Bank Service Charges |

||||

|---|---|---|---|---|

| Sr. No | Particulars | From 1.03.2022 | GST 18% | New Rate |

| 1 | Cheque/ ECS Return Charges | 150 | 27 | 177 |

| 2 | Account Operation Charges (Include SMS Half Yearly) | 98 | 18 | 116 |

| 3 | Current A/c (SMS/Monthly statement By E-mail/ect. harges Half Yearly) | 229 | 41 | 270 |

| 4 | C.C. A/c (SMS/Monthly statement By E-mail/ect. Charges Half Yearly) | 590 | 106 | 696 |

| 5 | Gold or Wear House Loan Processing Fees ( Half Year) | 229 | 41 | 270 |

| 6 | Other Loan A/c. (SMS/Monthly statement By E-mail/ect. Charges Half Yearly) | 229 | 41 | 270 |

| 7 | Cheque Stop Payment | 50 | 9 | 59 |

| 8 | Demand draft commission (Minimum & Maximum amt. ) | 10 | 2 | 12 |

| 9 | Hundi commission | 10 | 2 | 12 |

| 10 | Loan Application Fees (All Loan) | 100 | 18 | 118 |

| 11 | No Dues certificate | 50 | 10 | 60 |

| 12 | Inoperative ( Half Yearly Charges) | 98 | 18 | 116 |

| 13 | Missed or Second Passbook Charges | 30 | 6 | 36 |

| 14 | Cheque Book Charges (Per Cheque, Non Finance) | 2 | 0 | 2 |

| 15 | O/W Retune Charges | 25 | 5 | 30 |

| 16 | A/c Closing Charges | 60 | 11 | 71 |

| 17 | Bank Guarantee Per 100 ( Include with GST) | 3 | 1 | 4 |

| 18 | Average Balance Charges (Average Balance 1000 Per Day) | 25 | 5 | 30 |

| 19 | Yearly ATM Charges | 200 | 36 | 236 |

| 20 | Signature Verification Charges | 100 | 0 | 0 |

| 21 | Insta Cheque Book Charges | With GST - 300 | ||

| 22 | RTGS /NEFT Charges | Nil | Nil | Nil |

| ABB CHARGESS (INTER Branch Charges ) | Nil | Nil | Nil | |

| 1 | For All SA,CA,CC A/c & Inter Branch (Cash Deposit/Withdrawal Charges)Per entry | Nil | Nil | Nil |

| Locker Charges | ||||

| 1 | A Type 6 inch *18 inch | With GST - 600 | ||

| 2 | B Type 12 inch *18 inch | With GST - 1200 | ||

| 3 | C Type 18 inch * 18 inch | With GST - 1800 | ||

| Cash Credit Renewal or Overdraft Processing Fees | ||||

| 1 | Up to 100000 | 250 | 45 | 295 |

| 2 | 100001 to 200000 | 350 | 63 | 413 |

| 3 | 200001 to 500000 | 600 | 108 | 708 |

| 4 | 500001 to 2500000 | 900 | 162 | 1062 |

| 5 | 2500001 to 500000 | 1000 | 180 | 1180 |

| Loan Processing Fees | ||||

| 1 | UP to 100000 | 500 | 90 | 590 |

| 2 | 100001 to 200000 | 700 | 126 | 826 |

| 3 | 200001 to 500000 | 1000 | 180 | 1180 |

| 4 | 500001 to 2500000 | 1500 | 270 | 1770 |

| 5 | Up to 2000000 Loan Search Report & Reg. Mortgaged fees of Lawyer | 2000 | 360 | 2360 |

| 6 | 2000000 and above Loan Search Report fees & Reg. Mortgaged fees of Lawyer | 2500 | 450 | 2950 |

| 7 | Property Valuation fees | 1850 | 333 | 2183 |

| 8 | Unit Visit Charges | 500 | 0 | 500 |

| 9 | Gold Loan Processing Fees | 0.50% | 0.00 | 0.50% |

| Individual Customer & Commercial / Non Individual Customer | ||||

| Overdue Amount | Charges Monthly | |||

| 1 | Rs. 10,000.00 Upto | Rs. 150 + GST | ||

| 2 | Rs. 10,000.01 To 50,000.00 | Rs. 350 + GST | ||

| 3 | Rs. 50,000.01 To 2,00,000.00 | Rs. 500 + GST | ||

| 4 | Rs. 2,00,000.01 To 5,00,000.00 | Rs. 1000 + GST | ||

| 5 | Rs. 5,00,000.01 To 10,00,000.00 | Rs. 1500 + GST | ||

| 6 | Rs. 10,00,000.01 To 25,00,000.00 | Rs. 2000 + GST | ||

| 7 | Rs. 25,00,000.01 To 50,00,000.00 | Rs. 3000 + GST | ||

| 8 | Rs. 50,00,000.01 To 1,00,00,000.00 | Rs. 4000 + GST | ||

| 9 | Rs. 1,00,00,000.01 To 5,00,00,000.00 | Rs. 5000 + GST | ||

| 10 | Rs. 5,00,00,000.01 and Above. | Rs. 7000 + GST | ||

| Solvency Certificate | 354 | 64 | 418 | |

| 1 | Up to 100000 | 590 | 106 | 696 |

| 2 | 100001 to 500000 | 885 | 159 | 1044 |

| 3 | above 500000 | 1000 | 180 | 1180 |

Inter Branch Transactions

Core Banking Solution has facilitated Any-where Banking facility through all our Branches and Extension Counters

ATMs

Installation of ATMs at each of our branches.

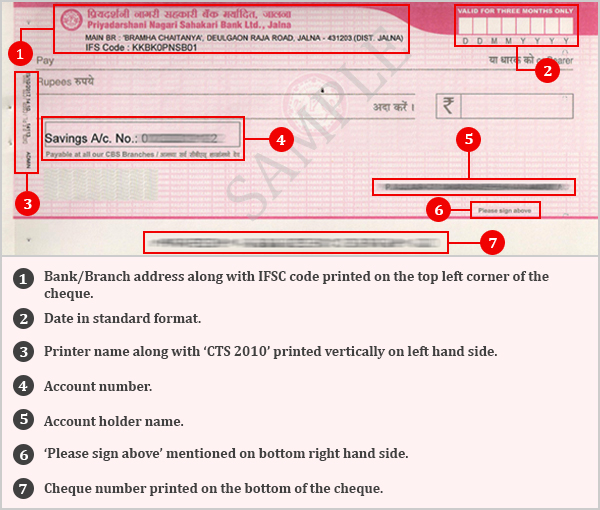

CTS Cheque Book Facility

This facility has helped many of our corporate/commercial clients in their business.

To help you identify whether the cheque book you currently hold is CTS compliant or not, you can look for the following features:

1. Words 'CTS 2010' printed on the left hand side of the cheque leaf near perforation

2. All cheques carry a standardised watermark, with the words 'CTS-INDIA' which can be seen when held against any light source.

3. Pantograph with hidden / embedded word 'VOID' is included in the cheques. The word is clearly visible in photocopies of a cheque.The right hand corner of the cheque leaf has Boxes provided for the date which is in the DD/MM/YYYY format

Please sign above" is mentioned on cheque leaf on the lower right-hand side.

If you have a Personalised Cheque Book it is CTS 2010 format.

Click here to see the new format of the cheque.

RTGS / NEFT

RTGS (Real Time Gross Settlement) and NEFT (National Electronic Funds Transfer) are the facilities under which, customer can transfer funds from our Bank to any another Bank.

The minimum amount for customer transactions through RTGS is Rs.2 Lakhs while there is no amount restriction for NEFT transactions.

As per the RBI guidelines RTGS as well as NEFT will be credited to beneficiary account on only the basis of Beneficiary account number. Therefore, the originator of transaction will have to ensure that the correct Beneficiary Account number has been written in the Funds Transfer Application Form.

Customer has to mention his own Account Number as well as Beneficiary’s Bank’s Name, Account Number, IFSC Code and Amount correctly.

e-Payment of Taxes

In this facility our customers can pay their Direct Taxes and Indirect taxes debiting their account through our Bank

General Insurances

Reserve Bank of India has permitted us to engage in General Insurance business as a corporate agent. We have tied up with Bajaj Allianz General Insurance Company Ltd. for offering its policies to our customers. These General Insurance products are available at all of our branches

Life Insurance Business

Reserve Bank of India has permitted us to engage in Life Insurance business as a corporate agent. We have tied up with M/S Bajaj Allianz Life Insurance Company ltd. These life insurance products are available at our all branches

SMS Banking

Information regarding balance in account, Details of last 3 transactions and status of cheque deposited for clearing etc. can be obtained through SMS Banking

Payment Facility

Customers can pay their electricity bill, mobile recharges, telephone bill, DTH Bill mobile postpaid bill by way of electronic debits to their Accounts with us. This service is offered free of cost to our customers

Transaction Alerts

The techno based facility is introduced for the customers to inform the details of transactions on their mobile through SMS. Alerts are sent online as soon as transaction is effected on the account.

Rupay Debit Cards

The Priyadarsani Nagari Sahakari Bank Rupay Debit card gives its customers the cashless and safe shopping experience while

1. Buying groceries at Supermarkets & Departmental stores

2. Shopping at your favourite outlets.

3. Dining at fine restaurants

4. Petrol/ Disel filling

5. Cash withdrawals at ATMs

6. Paying bills

E-lobby

Bank has started E-Lobby service with an intention to serve the customers beyond working hours. Presently E-Lobby is started at some prime locations. In E-Lobby customer will be able to update his passbook, deposit a cheque and use ATM for cash withdrawal. This facility is available to customers 24x7. Bank has also started cash deposit Kiosk at its jalna branch. Customers can now deposit Cash in the kiosk beyond banking hrs.

ECS Banking (NACH)

This facility provides you the ease of regular payments being made hassle free by providing just one mandate. You can regularise your scheduled emi payments, bill payments etc via this facility.

24 x 7 ATM

The PRIYADARSANI NAGARI SAHAKARI BANK LTD ATM's are interconnected via RuPay to network of ATMs of National Financial Switch.

Services that our ATM centers provide :

Please note that Cash Retraction Facility in ATM’s is disabled.

1. Balance Enquiry & Cash withdrawal.

2. Similarly you can use also your PRIYADARSANI NAGARI SAHAKARI BANK LTD Bank ATM Card on any of the NPCI Network

SUPPORT

Priyadarshani Nagari Sahakari Bank Ltd.

1 floor, ‘‘Bramha Chaitnya’’ Deulgaonraja Road, Jalna – 431203

Phone No. :

02482 – 235737, 233346, 256256, 252500, 228128

Fax No. : 02482 - 241107

For Mobile banking support :

02482-233346

mobilebanking@priyabank.com

For ATM support :

02482-233346

mobilebanking@priyabank.com